Categories

July 25, 2019

Introducing the GRIT ‘Top 50 Most Innovative’ Tech, Service, Analytics, Consulting & Emerging Suppliers

Take a peek at the GRIT ‘Top 50 Most Innovative Suppliers’ sublists.

0

We discussed the 2019 Business & Innovation edition’s overall GRIT ‘Top 50 Most Innovative Suppliers’ in Market Research. However, the roots of GreenBook are based on developing directories of the industry, which means a taxonomic view of the industry. We view the industry through categorical structures. With that default perspective, over the history of GRIT we have worked to implement a cohesive and flexible segmentation model using our long history of taxonomic expertise. Our screening questions were the beginning of this process, and last year we implemented our Lumascape model to expand on our vision of creating the most comprehensive segmentation model of the insights and analytics industry available.

In this wave, we took that a step further and inserted a “big bucket” classification question into the GRIT Top 50 section to help tie everything together further.

We asked respondents to categorize the companies they listed as most innovative in six groups:

- Data & Analytics Providers

- Full/Field Service Agencies

- Qualitative Suppliers

- Strategic Consultancies

- Technology Providers

- “Other” (Emerging Players)

Our goal here was to accomplish a few things: to showcase even more companies that are leaders in specific areas, to understand how companies are perceived in the marketplace, and to compare how companies are perceived by the market versus how they are positioned by their own employees via the Lumascape (which we cover in the Lumascape section of the full GRIT Report).

The result is six new “GRIT Top 50” sub-category lists for each segment.

All of the rules we developed for the main GRIT 50 list were applied here as well, with the additional filter of looking at mentions just within the category.

There is a significant amount of overlap with the main list (often with the same company appearing on multiple lists), but also many entrants that did not qualify for the GRIT Top 50 but have strong category-specific showings. Please note that to save space, the tables below only include the Top 25 for each list. The full lists for each category can be found in the GRIT Report.

Data & Analytics |

Mentions | Rank |

| Nielsen | 102 | 1 |

| Kantar | 66 | 2 |

| Dynata | 52 | 3 |

| LRW | 49 | 4 |

| Ipsos | 44 | 5 |

| Zappi | 41 | 6 |

| Qualtrics | 35 | 7 |

| 34 | 8 | |

| Delvinia | 29 | 9 |

| Hotspex | 29 | 10 |

| AYTM | 28 | 11 |

| System 1 Group | 27 | 12 |

| IRI | 20 | 13 |

| Toluna | 20 | 14 |

| GfK | 16 | 15 |

| PRS IN VIVO | 15 | 16 |

| Black Swan Data | 15 | 17 |

| Dig Insights | 15 | 18 |

| Numerator | 14 | 19 |

| MetrixLab | 13 | 20 |

| 1Q | 12 | 21 |

| SKIM | 12 | 22 |

| Living Lens | 11 | 23 |

| KnowledgeHound | 10 | 24 |

| Lucid | 10 | 25 |

Full and/or Field Service |

Mentions | Rank |

| Ipsos | 176 | 1 |

| Kantar | 136 | 2 |

| Nielsen | 74 | 3 |

| Hotspex | 74 | 4 |

| LRW | 71 | 5 |

| System 1 Group | 69 | 6 |

| Insites Consulting | 58 | 7 |

| Dynata | 45 | 8 |

| PRS IN VIVO | 42 | 9 |

| Dig Insights | 38 | 10 |

| SKIM | 28 | 11 |

| MetrixLab | 23 | 12 |

| Zappi | 20 | 13 |

| Lucid | 19 | 14 |

| GfK | 18 | 15 |

| Shapiro & Raj | 17 | 16 |

| Delvinia | 15 | 17 |

| Toluna | 15 | 18 |

| Join the Dots | 14 | 19 |

| AYTM | 13 | 20 |

| TRC Market Research | 12 | 21 |

| 20/20 Research | 11 | 22 |

| Hall & Partners | 11 | 23 |

| Maru/Matchbox | 11 | 24 |

| Schlesinger Group | 11 | 25 |

Qualitative Research |

Mentions | Rank |

| Ipsos | 32 | 1 |

| Kantar | 24 | 2 |

| Hotspex | 20 | 3 |

| Remesh | 17 | 4 |

| Discuss.io | 15 | 5 |

| Insites Consulting | 13 | 6 |

| Voxpopme | 13 | 7 |

| System 1 Group | 11 | 8 |

| iTracks | 10 | 9 |

| Nielsen | 9 | 10 |

| Living Lens | 9 | 11 |

| Shapiro & Raj | 8 | 12 |

| Dynata | 7 | 13 |

| 20/20 Research | 7 | 14 |

| Brado Creative Insights | 7 | 15 |

| DScout | 7 | 16 |

| PRS IN VIVO | 6 | 17 |

| AYTM | 6 | 18 |

| Hall & Partners | 6 | 19 |

| Happy Thinking People | 6 | 20 |

| Schlesinger Group | 6 | 21 |

| Toluna | 6 | 22 |

| LRW | 5 | 23 |

| Brand Dynamics | 5 | 24 |

| Digsite | 5 | 25 |

Strategic Consultancy |

Mentions | Rank |

| LRW | 77 | 1 |

| Hotspex | 60 | 2 |

| Kantar | 54 | 3 |

| System 1 Group | 54 | 4 |

| Insites Consulting | 32 | 5 |

| Ipsos | 30 | 6 |

| Nielsen | 29 | 7 |

| Kelton Global | 19 | 8 |

| Shapiro & Raj | 19 | 9 |

| PRS IN VIVO | 18 | 10 |

| Dig Insights | 16 | 11 |

| SKIM | 16 | 12 |

| McKinsey | 14 | 13 |

| Gongos | 10 | 14 |

| Protobrand | 9 | 15 |

| MetrixLab | 8 | 16 |

| C Space | 7 | 17 |

| De la Riva Group | 7 | 18 |

| Reach3 Insights | 7 | 19 |

| BVA Group | 6 | 20 |

| Accenture | 6 | 21 |

| Bain & Company | 6 | 22 |

| Deloitte | 6 | 23 |

| Directions Research | 6 | 24 |

| GfK | 6 | 25 |

Technology |

Mentions | Rank |

| Zappi | 127 | 1 |

| Qualtrics | 99 | 2 |

| Voxpopme | 80 | 3 |

| Living Lens | 58 | 4 |

| Remesh | 55 | 5 |

| Delvinia | 48 | 6 |

| 40 | 7 | |

| Focus Vision | 39 | 8 |

| Lucid | 38 | 9 |

| AYTM | 34 | 10 |

| Fuel Cycle | 26 | 11 |

| Toluna | 24 | 12 |

| iTracks | 20 | 13 |

| KnowledgeHound | 20 | 14 |

| Dynata | 18 | 15 |

| IBM | 16 | 16 |

| Discuss.io | 16 | 17 |

| Upsiide | 13 | 18 |

| Rival Technologies | 12 | 19 |

| Microsoft | 11 | 20 |

| Vision Critical | 11 | 21 |

| 20/20 Research | 10 | 22 |

| Apple | 10 | 23 |

| GroupSolver | 10 | 24 |

| SurveyMonkey | 10 | 25 |

Other/Emerging Players |

Mentions | Rank |

| Lucid | 11 | 1 |

| System 1 Group | 8 | 2 |

| Dynata | 7 | 3 |

| Ipsos | 6 | 4 |

| LRW | 5 | 5 |

| Hotspex | 4 | 6 |

| Zappi | 4 | 7 |

| AYTM | 3 | 8 |

| 3 | 9 | |

| P2Sample | 3 | 10 |

| Qualtrics | 3 | 11 |

| Voxpopme | 3 | 12 |

| PRS IN VIVO | 2 | 13 |

| Delvinia | 2 | 14 |

| PureSpectrum | 2 | 15 |

| Insites Consulting | 2 | 16 |

| Buzzback | 2 | 17 |

| Canadian Viewpoint | 2 | 18 |

| Eyeka | 2 | 19 |

| Fuel Cycle | 2 | 20 |

| Living Lens | 2 | 21 |

| Pollfish | 2 | 22 |

| Prodege | 2 | 23 |

| Remesh | 2 | 24 |

| Toluna | 2 | 25 |

Our first takeaway is that the respondent’s experience with a company dictates how they see them. Similar to the adage of the blind men and the elephant, depending on how you interact with a company you may see them differently. For large organizations that offer a wide breadth of services such as Ipsos, Kantar, Nielsen, etc… that is unsurprising and perhaps even on-brand, but for a company like Zappi for instance, that touts itself purely as a technology provider, it is curious that respondents see them as fitting into all six categories! The same is true for many other companies that we think of as having a very clean categorical fit, but respondents have challenges in categorizing them.

The first five categories are self-explanatory, but the “Other” deserves a bit more attention. This was an “other/specify” in the questionnaire and the results were all over the place. In some cases, respondents were clearly attempting to break out of the pack by creating new categories for these companies, but we generally were able to map them back to the big buckets and include them there. That left us with a few legitimate “others” which we identified as having a major attribute in common: they are mostly technology-driven companies who are pioneering new methods or a differentiated value prop from traditional players. While we appreciate the efforts to carve out new categories for themselves, the industry still primarily thinks along the qual/quant and tech/service quadrants, so an effort needs to be made to map their efforts at differentiation to the existing paradigm as a point of reference.

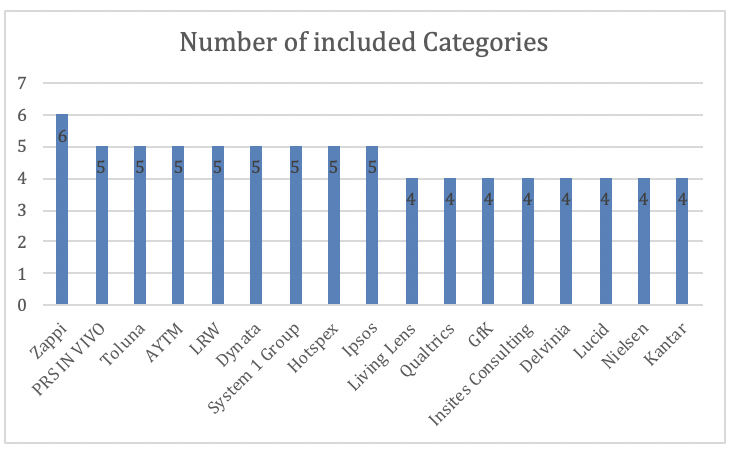

Here is a look at a few of the companies that appear in four or more category lists as an example of this possible positioning confusion:

Clearly, many companies do not have the same challenge because they do only appear on one list, and their categorical assignment by respondents fits with the positioning of the company (20/20 Research and Schlesinger for instance in Qual). Based on this we don’t believe the issue was lack of knowledge by the respondents since many of the assigned categories match what we ourselves would have chosen for these companies.

Is this an example of suppliers increasingly trying to be “all things to all people”, a symptom of “experiential tunnel vision” by respondents, or is it indicative of challenges companies have in clearly communicating their positioning? Or is it a mix of all three?

In the Lumascape section of the main GRIT Report, we explore this more and look at the differences between how companies “self identify” vs. how they are perceived; however, the answers are not as clear as we would like. Our working hypothesis is that the lowest common denominator here is how suppliers market and position themselves; it is the only means they have in impacting positioning perception. For those that are “one-stop shops,” this may not be a challenge, but there is a significant risk for more focused organizations of potential buyers being confused as to their offerings and not including them in their consideration.

The Big Picture

We see evidence of potential brand confusion across many suppliers, especially newer firms working to differentiate themselves from legacy providers. Whether this is due to limits of understanding by the market or challenges with marketing by these companies is to be determined, but in the meantime we can only suggest that supplier community work to sharpen their messaging, use the context their audience can relate to, and increase their overall reach to penetrate more into the mindshare of the industry.

Disclaimer

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

Comments

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

More from Leonard Murphy

CEO Series

From Rockstar Dreams to AI Insights: The Journey of Hamish Brocklebank

Dive into the CEO Series with guest Hamish Brocklebank, CEO of Brox.AI. Explore his path from music ...

CEO Series

AI Integration and the Future of Marketing Insights with Alex Hunt, CEO of Behaviorally

Explore the power of AI in marketing with behaviorally's CEO, Alex Hunt. Learn how to leverage predi...

Research Technology (ResTech)

The Next Wave of Disruptive Technology that Changes Everything

There have been a few big inflection points of societal disruption driven by technology in the last 50 years: One was the introduction of the Internet...

Insights Industry News

Quantifying the Impact of Insight Innovation

We previously announced the milestone of our Insight Innovation Exchange (IIEX) conference series’ 10th anniversary, celebrating a decade of identifyi...

ARTICLES

Top in Quantitative Research

Research Methodologies

Moving Away from a Narcissistic Market Research Model

Why are we still measuring brand loyalty? It isn’t something that naturally comes up with consumers, who rarely think about brand first, if at all. Ma...

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.

67k+ subscribers