Categories

November 28, 2017

5 Changes We Can Expect for the Future of Respondent Engagement

Learn about Virtual Incentives, Koski Research, Ask Your Target Market (AYTM) and GreenBook’s survey on respondent engagement and rewards.

0

The issue of respondent engagement and the impact of broader trends in engaging, understanding and activating consumer relationships on the research space has been an important topic in our industry for a long while, but perhaps not important enough. Over the last few years GreenBook has been partnering with a variety of leaders to build on efforts by others such as the GRBN and ESOMAR to drive the conversation even further and help our industry to rethink respondent engagement.

Earlier this year we published the GRIT CPR Report and found that the majority respondents who have willingly given up their time, often for little or no reward, are dissatisfied with the their experience participating in research. The implication was that as an industry we need to collectively increase our respect for those who take the time to answer our questions.

Central to the findings in that study was that an opportunity existed to fundamentally transform the relationships between consumers and insights generation by crafting fair value exchange reward systems as a core driver of respondent engagement.

That realization drove us to realize we needed to dive deeper into how consumers view rewards and what they are looking for in the future. In order to understand how consumers value and respond to rewards and incentives, Virtual Incentives, Koski Research and Ask Your Target Market (AYTM) and GreenBook partnered to develop and field a survey that looked at several key areas around the mindset for the Future of Rewards.

In this study we explored three major themes:

- Delivery channel preference

- Value in income and finances

- Role in brand engagement

The study was conducted in early September of 2017 as an online survey among 1,000 U.S. General Population representative sample.

The full report will be published soon and it is chock full of impactful insights, but five major implications were readily apparent. To add additional context to the findings, I’m going to interweave some other sources into this summary to give a “big picture” perspective.

1. Instant and Digital: Consumers place the highest value on incentive types that they can receive instantly and digitally. They also prefer incentive types which can be widely used like cash. Millennials, compared to other generations, are most enthusiastic about receiving their awards digitally. In fact, according to the FoR results 78% of consumers would prefer immediate mobile receipt of rewards in the future.

This dovetails with findings from the GRIT CPR study as well and clearly indicates that any type of rewards program, bet it research incentives or loyalty programs and rebates need to be instant and allow for recipient choice in how they customize the delivery vehicle.

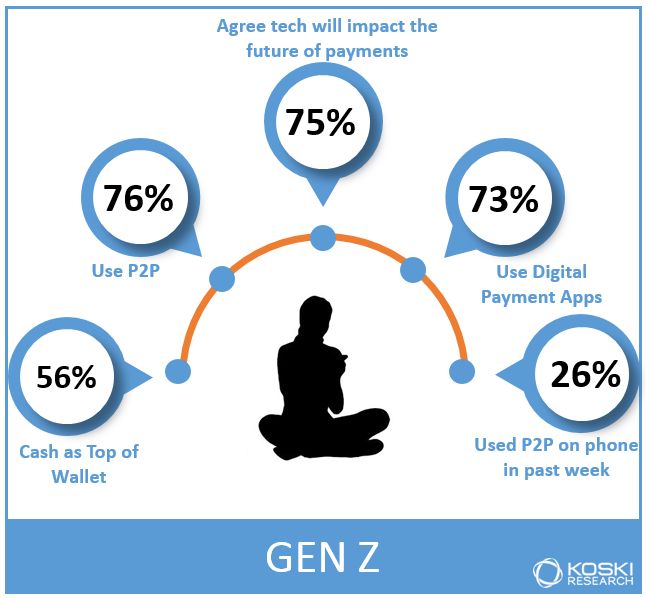

Koski Research had previously conducted a study on the Future of Money and highlighted specifically how Gen Z is using digital technology to transform how they deal with financial transactions:

Generation Z is coming of age in a time of huge transformation in the payment space. We know from our Future of Money study that Gen Z is both digitally engaged with money and also cash centric. In our study of the oldest Gen Zers, 16 to 18 year-olds, we found they are still very heavily cash oriented compared to the General Population—cash is top of wallet for Gen Z, whereas debit is top of wallet for the General Population of adults. At the same time, the majority of Gen Zers are already using digital payment apps.

These older teens acknowledge the changes happening with technology and money: three quarters (75%) say that technology will impact how we pay for things in the future. At the same time, Gen Z’s use of both P2P and digital payment apps is higher than the General Population. Over a quarter of these older Gen Zers say they have used P2P in the last week. We know this generation, like those before it, is forging a new path. They will likely lead even more transformative technological changes, having grown up with gaming, snapchatting, and with a small screen rarely more than an arms-length away. Will they jump from P2P to cryptocurrency or to something we haven’t discovered yet? We look forward to seeing how they will leapfrog payments technology beyond our current imaginations.

The implication is clear: as “FinTech” and technologies like Blockchain drive change in consumer financial behavior, in order to maximize engagement, we must adapt to stay responsive to trends.

2. Rewards Work for Consumers: Consumers are taking part in activities they wouldn’t have otherwise participated in, and believe they are being compensated fairly for providing meaningful information. We found that 70% say they only participate in research or loyalty/marketing activities for the rewards and 56% wouldn’t have done the activity if they were not incentivized.

Behavior change is the goal of marketing, and perhaps there is no more important aspect of that than in building engagement. Once consumers are engaged in the relationship, then participating in new, desired behaviors (like providing insights) is part of the system.

Unilever’s Keith Weed wrote about their program in the Harvard Business Review:

Brands can be even more powerful agents for change when we understand exactly how people use products, and what values, habits or motivations influence this use. We synthesized our own knowledge and experience as a marketing company with insights from experts from psychologists to academics and those out meeting the people who cook, clean and wash with our products every day. The result was Five Levers for Change, a set of principles brought together in a new approach we believe can increase the likelihood of achieving sustained behavior change:

Taking that idea of behavior change a step further, a recent article on the World Economic Forum site details the various alternative financial transaction models emerging globally, including Peer-to-peer “social currencies” based on negotiated value exchanges for information, goods and services.

Today, we are closer than ever to a financial revolution in which money will disappear and be replaced by something else. Physical banknotes will be substituted by local social currencies, points that you earn by doing social work, services, or companies’ own currencies based on customer loyalty, among others.

This digital bartering is part and parcel of today’s rewards ecosystem where consumers exchange time and resources for financial compensation. Digital reward programs are well positioned to become part of these alternative currency systems.

3. Rewards are Part of a Brand Engagement Strategy: Rewards have the power to sway consumer decisions, behind price but before brand. All companies should consider the power of rewards to tip the balance in their favor, especially those who may need to increase their brand equity.

Our data indicates that a whopping 75% say they feel more favorable toward a company that offers rewards and 69% feel more favorable toward a company that offers personalized messages or rewards.

Jonathan Price, CEO of Virtual Incentives, expounded on this in a recent interview with Loyalty360:

As it relates to loyalty, we found it fascinating how much incentives are now influencing choice in brand purchase. We believe in the power of a brand at Vi and recognize that consumers are still brand conscious, but now more than ever are willing to try new products and deviate from traditional brands. The data showed that following price, an incentive along with reviews were the top reasons for making a purchase decision. We know the power of reviews, especially when it comes to online purchase behavior, but we did not expect that consumers would indicate that the incentive was one of their top influences in making their purchase.

We are just beginning to dig into the data, but are going to focus our efforts around developing engagement vehicles for rewards that meet the channel preferences, influence in choosing a brand, and in a relevant form of currency to consumers.

Clearly, as a means of engaging, understanding and activating consumer relationships rewards play a large role, and in the vision of alternative currencies based on social relationships there is a significant opportunity to create “loyalist tribes” using reward programs as a currency.

4. Rewards are currency: For many respondents, reward programs for research and/or shopper and loyalty systems are augmentation to their incomes and often are used as currency.

Based on the FoR results, Rewards play an important financial role for many: 62% say they use the rewards to redeem or buy everyday items and 35% say it is part of the income they need.

The Economist has a series of articles related to the changing model of financial transactions emerging globally, and in the example below it hints heavily at how rewards may be part of a “currency exchange” that uses a variety of alternative currencies models to develop a universal marketplace for redemption into other forms.

“Before Babylon, Beyond Bitcoin” by David Birch, a consultant, offers a broad historical overview on the nature of this essential economic instrument. His underlying thesis is that money has evolved over the ages to suit the needs of society and the economy. Often these changes have occurred because previous forms of money were too inflexible. In the Middle Ages, metal coins were supplemented by bills of exchange to make long-term trade easier. Credit and debit cards have replaced the cumbersome process of clearing cheques.

Money may be about to change again. The author thinks cash will and should dwindle away. The future belongs, not to plastic cards, but to mobile phones. In Kenya, hundreds of businesses, including the leading utilities, accept payments through a mobile-based system known as M-Pesa (pesa means “money” in Kiswahili). More than two-thirds of adults use it. “With payment cards, you could pay retailers. With mobile phones, people can pay each other. And that changes everything,” he writes.

Furthermore, the future may see “frictionless” shopping. Hire an Uber car and there is no transaction with the driver. The app already has your credit-card details; when you leave the car, you simply shut the door and then get an e-mail with details of the bill. The same may apply in supermarkets in future. A reader will record the details of your purchases as you leave the shop and charge them to your account.

The future may see technology like Blockchain as the foundation for such universal currency exchanges, and rewards should be a significant part of that system.

5. Personal data is recognized as an asset: Consumers recognize their data has value and expect a fair value exchange for access and use of it.

We asked what data consumers would share in exchange for rewards and the results clearly indicate respondents, to varying degrees, are willing to monetize their personal data. Here are some examples at both ends of the “comfort” spectrum:

- Shopping habits: 75%

- TV consumption: 71%

- Spending habits: 61%

- Internet history: 39%

- Relationships: 32%

- Personal finances: 25%

As I previously wrote in this blog post on GreenBook Blog, In 2011 The World Economic Forum classified personal data as a new Asset Class along with property, investments, cash, etc. This laid the foundation to rethink how data can be utilized to deliver value to the owners and originators, not just the users. In the original report issued by WEF and Bain, they call out both the technical and philosophical challenge:

At its core, personal data represents a post-industrial opportunity. It has unprecedented complexity, velocity and global reach. Utilizing a ubiquitous communications infrastructure, the personal data opportunity will emerge in a world where nearly everyone and everything are connected in real time. That will require a highly reliable, secure and available infrastructure at its core and robust innovation at the edge. Stakeholders will need to embrace the uncertainty, ambiguity and risk of an emerging ecosystem. In many ways, this opportunity will resemble a living entity and will require new ways of adapting and responding. Most importantly, it will demand a new way of thinking about individuals. Indeed, rethinking the central importance of the individual is fundamental to the transformational nature of this opportunity because that will spur solutions and insights.

A multi-dimensional system that has real incentives and rewards that pay consumers for their participation in an accretive way is not only more fair — it also drives the shift in necessary thinking to support the emergence of the personal data economy. Whether it’s getting a “data access annuity” from Facebook or Google, direct compensation for participating in research or data analysis initiatives or receiving goods and/or services as a “lease” on consumer data access, each model has incentives at their core.

No longer a tactical afterthought, consumer rewards are the tip of the spear in leading a transformation in how consumers use their data for their own benefit vs. others using it for personal gain. Direct reciprocity simply changes the game.

So what does it all mean? In 2018, look for this topic to become even more important. In the era of individual marketing, brands will continue to focus on technologies and partners that help them engage, understand, and activate consumers on a one-to-one basis. This means reward programs to drive behavior will continue to take center stage.

Concurrently, the near-constant news around large scale hacks like Equifax and Yahoo combined with European initiatives like GDPR will force greater adoption of secure transactional technologies, and a new focus on gaining explicit consent from consumers for marketing and insights. This new level of accountability for data-driven marketing will mean more than evolving ToS for consumers; it will necessitate transparency on how data is used and its value, which will underline the point that personal data is an asset. As a result, expect new models of personal data monetization to emerge, led by opt-in panels, incentive providers and loyalty programs.

Disclaimer

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

Comments

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

More from Leonard Murphy

CEO Series

From Rockstar Dreams to AI Insights: The Journey of Hamish Brocklebank

Dive into the CEO Series with guest Hamish Brocklebank, CEO of Brox.AI. Explore his path from music ...

CEO Series

AI Integration and the Future of Marketing Insights with Alex Hunt, CEO of Behaviorally

Explore the power of AI in marketing with behaviorally's CEO, Alex Hunt. Learn how to leverage predi...

Research Technology (ResTech)

The Next Wave of Disruptive Technology that Changes Everything

There have been a few big inflection points of societal disruption driven by technology in the last 50 years: One was the introduction of the Internet...

Insights Industry News

Quantifying the Impact of Insight Innovation

We previously announced the milestone of our Insight Innovation Exchange (IIEX) conference series’ 10th anniversary, celebrating a decade of identifyi...

ARTICLES

Top in Quantitative Research

Research Methodologies

Moving Away from a Narcissistic Market Research Model

Why are we still measuring brand loyalty? It isn’t something that naturally comes up with consumers, who rarely think about brand first, if at all. Ma...

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.

67k+ subscribers