Categories

Insights Industry News

June 7, 2013

A Rising Tide Floats All Boats: Where Market Research Is & Where It Is Going

Four factors rising the tide for insights, and what they mean for the industry as a whole.

0

Obviously I am a bit obsessed about thinking about changes to the insights marketplace in general, but recently there has been a flood of information coming to me that has made that topic down right inescapable. As usual, all of these various data points float around in my head until a pattern begins to emerge, and at that point I know it’s time write it down and put it out there for you all to challenge. This post is my effort to do that.

My thesis is this: as expected, the pace of change in our industry is increasing. It’s being mostly driven by 3 forces working in tandem:

- Client Demand

- Technological Innovation

- Competitive pressure

None of this is a surprise, in fact we’ve been talking about this for quite some time. The difference I am seeing now is that we’re quickly shifting from the “cautious exploration” stage that has been the norm to ” mainstream adoption”.

My belief is based on 5 data points:

- The Confirmit Market Research Software Survey by meaning

- Client interest in IIeX participating supplier firms

- New offerings by mature suppliers

- Redefinition of the MR market by analysts

Let’s take a look at each in depth.

Confirmit Market Research Software Survey

Simon Chadwick and Peter Milla wrote a great review of the report in RW Connect recently. A few of their key takeaways were:

…One trend emerges very strongly that suggests an industry moving forward: after years of hype and raised expectations, the survey finds that mobile is indeed now going mainstream. Not only do the majority of research company technology executives (the primary sample for this survey) now consider mobile to be a viable method of data collection and respondent interaction, it is clear that more and more are actually using mobile. This is especially so in Asia-Pacific, which gives credence to the theory that emerging markets are more likely to leapfrog from paper over CATI and online straight to mobile.

…Another source of wonderment is the finding that only 17% of research firms are using or offering online communities – precisely the same as in 2009! (The figure is a little higher in North America). And research companies wonder why new competitors such as Communispace and Vision Critical have been so successful! Indeed, this replicates a finding in Cambiar’s 2012 Future of Research study that found that established research companies have virtually put out the welcome mat to new competition by refusing to provide new modalities in which their clients are interested and with which they want to experiment – mobile being one of them. We see that a change in this attitude is essential in order for research firms to prevent the loss of market share to new entrants.

Finally, there are warnings in here too for the big research software companies: rest on your laurels at your expense. The study finds a big appetite among research companies for changing their core data collection, analysis and reporting software. Often this reflects the desire for new tools and efficiency but also it represents a way of maintaining a competitive edge. Which goes to say that new entrants into this space will find a receptive audience. We respectfully suggest that big research software companies consider the importance of investment in new product development in this. Those that do will see rewards in terms of sales and market position. We are sure that Confirmit, the primary sponsor of this survey, have duly taken note!

I share this general take, although our own GRIT study indicates wider adoption than that reported in the meaning study, which I ascribe to sample differences (GRIT and meaning use very different sample frames). Overall the meaning report shows an awful lot of conservatism still driving the industry which I suspect is more of a reflection of business model legacy challenges than lack of awareness of market opportunity by participants. Across the board participants seem to be interested in newer capabilities at some level. In general, the report paints a picture of a the “traditional” MR industry beginning to adapt to change, albeit slowly.

That is an important consideration in my reading of the tea leaves here. If the meaning report reflects what is happening in a narrow slice of the market that tends to be the most conservative overall (and I think it does) then I think it’s safe to assume that more progressive players are further along in this change and dragging the laggards forward with them.

Client interest in IIeX Participants

One of the things that set IIeX apart from any other event in the insight space is our close collaboration with our Corporate Partners to help develop the agenda with their needs in mind. There are many ways we do that all through the process of producing the conference, but now that we are close to the “Big Day” one of the main objectives is about to be realized: connecting our partners directly with firms they are interested in meeting to explore working together.

I can’t share details obviously, but since I have been working to design the agenda based on client needs, including components such as the Insight Innovation Challenge that was entirely driven by client feedback, and set-up private meetings during the conference between our partners and the firms they are most interested in I can share some broad trends.

- Emotional measurement is in a hot state. Although we are dedicating a whole track on emotional measurement and neuroscience during the conference honestly I was shocked by how many suppliers offering variations of these approaches are participating in the event and the level of interest in them by clients. A good chunk of the private meetings are devoted to meeting suppliers who offer some twist on these approaches, with the majority being scalable, web-driven solutions vs. more lab-based methods such as EEG. Eye tracking, facial scanning, behavioral economics, game mechanics, and cognitive neuroscience are all of VERY high interest to client organizations.

- Mobile is mainstream. Another area of high interest is mobile, although not mobile surveys. Rather mobile ethnography, passive measurement, media metering, and consumer experience approaches are rising to the top. Client organizations are very interested in these models. On the survey front I think that is seen as a given; surveys are easy and are part of the mix, but again anything that helps them understand the behavior of consumers is the prime driver of interest.

- Data Visualization is attractive. Another surprise was the interest in various new visualization approaches, especially those based on dashboard or data management platforms. PowerPoint may still be most used from a lowest common denominator perspective, but certainly there is intense desire to move past it to more integrated and sophisticated analysis and reporting tools.

- Micro-surveys are big. Love ’em or hate ’em, the era of byte-sized surveys is here and is gaining ground quickly. There seems to be particular interest in migrating big, expensive trackers to the micro-model.

By no means is the interest limited to these technologies; communities, social media analysis, co-creation, crowdsourcing, single-source/omni-channel data, DIY in all it’s permutations and more traditional techniques are certainly well represented at the event and clients are expecting to engage with these suppliers as well. My key take-away here is that market forces continue to be at play and that clients are speaking very loudly that they not only want innovation, but demand it, and are investing time and treasure into fulfilling this need. The industry would do well to listen.

And for you naysayers out there, this client-matching program is totally free; clients told us who they wanted to meet and we connected them with attending suppliers . In many cases we recruited suppliers they wanted to meet and comped them. This is an accurate reflection of their interests, not some paid speed dating scheme.

New offerings by mature suppliers

I am often asked to function as an industry analyst and review new offerings from suppliers from that perspective. Although certainly not exhaustive, I think I get a pretty broad view of the market and a few things have jumped out at me lately through both private briefings and public announcements that indicate mature supplier organizations are increasingly working to adapt to client needs with new offerings.

Here are three examples.

You might recall that international marketing services company SDL purchased Alterian last year. SDL is a 20 year old company with an impressive track record of growth and line extensions. Their technology and services help brands to predict what their customers want and engage with them across multiple languages, cultures, channels and devices. SDL has over 1,500 enterprise customers, 400 partners and a global infrastructure of 70 offices in 38 countries. 42 out of the top 50 brands work with them. They have not been considered an insights supplier, up until now.

After digesting the Alterian acquisition they have been hard at work developing a new offering they call the Customer Commitment Framework. Here is an excerpt from the launch press release:

With CCF, marketers, services professionals and strategists can more accurately develop and measure product, brand, and engagement strategies to drive growth and increase revenues, and also leverage those insights for executing more effective Customer Experience Management programs.

Until now, companies primarily have looked at social media as a channel for deploying advertising or brand campaigns, listening for customer or technical support, crisis management, and sentiment monitoring. As not all conversations are created equal, the CCF captures those social media conversations that are most important to understanding the three fundamental journeys all businesses need to enable for success — Shopping, Sharing and Advocacy –and applies its patented algorithms to the social dataset.

The CCF includes an Analytics Framework that works in conjunction with SDL SM2, its highly-rated social media monitoring application, and integrates through the rest of the SDL stack including content management and other analytics tools. The Framework takes the same social datasets and structures them into a series of predictive measures that C-level executives can understand, relate to, and trust as a decision making tool.

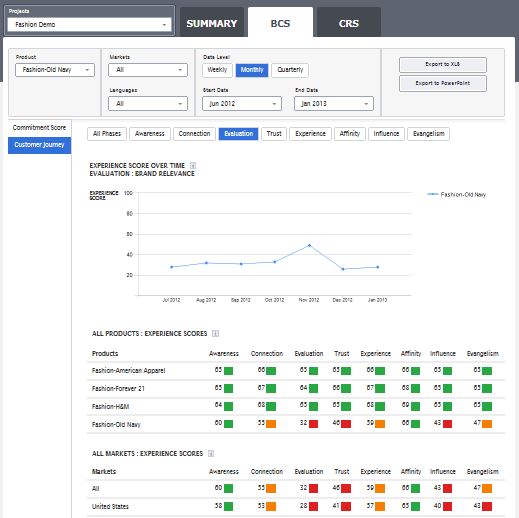

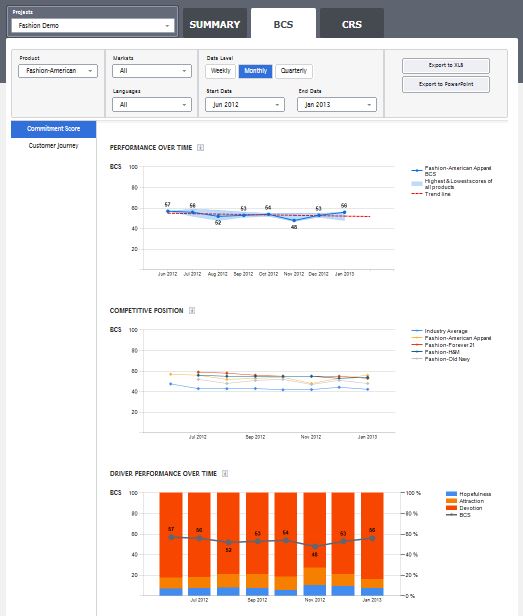

The analytics, CCF measures and diagnostic tools are visualized via the SDL Customer Commitment Dashboard (CCD), an intuitive interface that enables a real-time view into the KPIs and the Customer Journey so organizations can quickly course-correct programs and processes since the CCF benchmarks predict customer behavior against the competition.

I saw a demo of CCF in action recently and I was impressed. It’s an elegant and simple solution that moves social media analysis from the realm of basic sentiment analysis into a more integrated and impactful set of metrics that are aligned with the core concerns of the C-suite. Here are a few screenshots to show you what I mean.

Like other recent developments in the social space (covered here and here) CCF is an evolutionary leapin the integration of social media analytics, more traditional quant and qual research and business intelligence-focused consulting. It’s very much in line with the vision of the socially driven organization of the future outlined by Andrew Needham we posted earlier this week.

The second example of a mature company launching new offerings that integrate new technology and thinking is the newest Ipsos division, Ipsos SMX.

Ipsos SMX’s mission is to provide clients with new approaches to market research that focus on consumer engagement and consumer interactions. Their vision is inspired by changes in consumer behavior, resulting from innovations in the social media landscape. Their solutions focus on Communities, Social Listening and Mobile. They were incubated from the Ipsos Global Innovation Center, with established platforms and clients in all major sectors and territories.

Although I have not seen their offering first hand, the very fact that Ipsos has invested in developing a new division focused on non-traditional approaches while reporting a decline in research revenue earlier this year should be a strong indicator of the direction of the market place.

Finally just last week comScore announced their shift to omni-channel measurement. The goal of the new offering is to help clients drive brand loyalty and increase revenue by applying multi-platform measurement expertise to digital business analytics.

The new platform aims to help businesses gain a more in-depth understanding of their customers’ behaviors across their products and properties. The new offering builds on comScore’s Digital Analytix, a technology used to help companies better understand their digital customers’ behaviors.

Again, I haven’t reviewed Digital Analytix, but clearly comScore is reacting not just to technology trends, but also to the plethora of new entrants into multi-channel measurement such as Xbox, Tivo, Google, and many more platform owners.

Those are just three examples off the top of my head; there are hundreds more that show this shift of established companies racing to to adapt and incorporate new approaches into their wheelhouse. None of this is a “me too” effort; it’s based on market demand.

Redefinition of the MR market by analysts

Last year the MRS engaged with PriceWaterhouseCooper to resize the UK insights market and although some viewed the conclusions as perhaps a bridge too far, overall I think it was a great effort to recognize that the definition of “market research” and “insights” is radically different today than it was just five years ago, let alone when other industry sizing projects such as the Honomichl Report and ESOMAR Global Study were implemented. Similar to my concern with the meaning report and even our own GRIT study, these industry reports, although wonderful in the information they do provide, are reflective of an increasingly narrow slice of the market place and not of the current reality on the ground.

Here is a bit more on the MRS report:

The report, entitled, The Business of Evidence, concluded that the market is 50% larger than previously estimated and is now bigger than both the UK’s music and newspaper industries. It concludes that traditional definitions of ‘market research’ no longer hold true, with many more organizations and businesses undertaking research activities than had been realized.

For the purposes of this project we are defining market, social and/or opinion research – the ‘business of evidence’- as:

“The collection and interpretation of customer, citizen or business information for the purpose of informing commercial and public policy decisions, improving management of customer or civic relationships, or improving commercial or public management efficiency.”

The MRS is not alone in this effort. I have had several conversations with organizations in the business information industry lately on redefining the “insights” sector via a segmentation and market sizing exercise. We’ve compared notes on our own views and there is surprising similarities between our takes. Here is a snippet of my own working segmentation model:

Again, wearing my analyst hat this view is informed by trends in the marketplace and my awareness of the expanding competitive set within MR through client side relationships.

I fully anticipate new efforts to be launched in short order to quantify this vision of the market place and provide metrics on not just market sizing but actual deal flow that will help us better understand the changing landscape.

The implications for the industry

As the post title indicates, I think all of this is good news for the insights industry, although certainly not for all of the current suppliers that fit within the “traditional” bucket. A rising tide does indeed float all boats, and as the value of insights to drive business growth continues to be recognized, everyone who delivers quality will benefit. There is a caveat there though: traditional MR doesn’t own the definition of what “quality” is. Rather I believe quality will be defined by the measurable business impact of how the insight is operationalized regardless of method or model used to generate the insight. My reason for that belief is exemplified by the 4 data points I just outlined.

As research professionals we value our position as objective scientists and well we should. In that same vein we must be open to new thinking and test ideas on their own merits to prove their value. Science by it’s very nature is based on constant experimentation and refinement, on asking new questions and challenging the orthodoxy of the status quo. Certainly sometimes that means old models are discarded as new models are proven, but most often it is an iterative and evolutionary process that builds and expands upon previous knowledge bases to improve them. That is what is happening today: real challenges exist and many brilliant people are applying the spirit of scientific discovery to solve them. That is cause for rejoicing, not the gnashing of teeth. Change is hard but it is inevitable, and those who embrace the possibilities of change tend to prosper.

If your boat isn’t rising with the tide, you can either patch the hull, jump on someone else’s boat, get a new boat, or sink. The tide is rising very quickly indeed for our space and everyone involved needs to decide their course of action because the tide is unstoppable.

By the way, Simon Chadwick, Peter Milla, SDL and Ipsos SMX will all be participating in IIeX; if you are not coming you’re missing a golden opportunity to see much of what is informing my view for yourself.

Disclaimer

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

Comments

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

More from Leonard Murphy

CEO Series

From Rockstar Dreams to AI Insights: The Journey of Hamish Brocklebank

Dive into the CEO Series with guest Hamish Brocklebank, CEO of Brox.AI. Explore his path from music ...

CEO Series

AI Integration and the Future of Marketing Insights with Alex Hunt, CEO of Behaviorally

Explore the power of AI in marketing with behaviorally's CEO, Alex Hunt. Learn how to leverage predi...

Research Technology (ResTech)

The Next Wave of Disruptive Technology that Changes Everything

There have been a few big inflection points of societal disruption driven by technology in the last 50 years: One was the introduction of the Internet...

Insights Industry News

Quantifying the Impact of Insight Innovation

We previously announced the milestone of our Insight Innovation Exchange (IIEX) conference series’ 10th anniversary, celebrating a decade of identifyi...

ARTICLES

Top in Quantitative Research

Research Methodologies

Moving Away from a Narcissistic Market Research Model

Why are we still measuring brand loyalty? It isn’t something that naturally comes up with consumers, who rarely think about brand first, if at all. Ma...

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.

67k+ subscribers